Jim Tobin, A Friend Of Liberty (1945-2021)

May 2nd, 2022

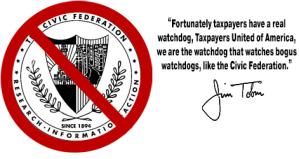

CHICAGO — The Civic Federation, described by the Chicago press as “One of the state’s most prominent tax watchdog groups,” or a “Taxpayer’s watchdog group,” may be a watchdog for banks,  large corporations and special interests invested in the status quo, but it certainly is not a watchdog on behalf of taxpayers, according to Jim Tobin, President of Taxpayers United of America (TUA).

large corporations and special interests invested in the status quo, but it certainly is not a watchdog on behalf of taxpayers, according to Jim Tobin, President of Taxpayers United of America (TUA).

The Civic Federation was established by Chicago bankers around 1900, and supported tax increases to pay dubious bank loans to state and local governments. Described by the author of “Taxpayers in Revolt,” David T. Beito, as “A conservative champion of the status quo,” a review of its leadership in 1931 revealed that 20 of its 21 officers and executive committee members were included in Who’s Who in Chicago, and that 10 of the 21 appeared in the Social Register.

The Federation defended the 1930 property tax assessment, fearing the possibility of a tax strike by ARET, The Association of Real Estate Taxpayers. It tried to nip the tax strike in the bud, warning, in its Feb. 1931 Bulletin, “Dangerous not to pay tax bills.”

Many of these 21 movers-and-shakers had multiple corporate directorships, usually of regional or national banks. These banks and utilities owned a large block of Chicago’s outstanding warrants and municipal bonds. Even in the depths of the Great Depression, the Civic Federation represented Chicago financial power brokers, and not the average citizen.

The Civic Federation supported creation of the state income tax in 1969. It also supported state income tax increases in 1989, 1991, and 1993.

In the 87th Illinois General Assembly (1991-1992), the Civic Federation supported SB 1378, which raised the state income tax 20% for corporations and individuals. The $800 million tax increase each year wiped out 10,000 Illinois jobs annually.

In the 88th Illinois General Assembly (1993-1994), the Civic Federation supported SB 937, which raised the state income tax $450 million, preventing the creation of 5,000 Illinois jobs every year. SB 937 raised the state personal income tax 9%, and the state corporate income tax 6%, from 6.9% to 7.3%.

In November 1993, the Civic Federation proposed a 6% “cable tax,” which would have extended Chicago’s 6% transaction tax on the lease or rental of personal property to cable television services. It also recommended raising the tax on downtown parking by 50 cents a day.

In November 1994, the federation urged Cook County voters to reject an advisory referendum asking if property tax caps should be extended to Cook County.

In 1995, the Civic Federation urged Mayor Daley to increase taxes in order to fund a renovation of Soldier Field. Even Daley, no friend of taxpayers, expressed surprise that the federation would advocate a tax increase for a stadium that would be used for just 10 games a year. The federation’s president, William Hudnut III, was quoted as saying, “It’s not always good for the taxpayers never to increase taxes.”

Not content with its previous tax-hike recommendations, the Civic Federation, in early 2010, recommended that the state income tax be increased 67%, from 3% to 5% for individuals and the tax on cigarettes be raised by another $1 per pack. Still not content, the federation also recommended that corporations lose $181 million in tax breaks.

The Illinois General Assembly did in fact increase the state personal income tax 67% for four years, and the state corporate income tax from 7.3% to 9.5% in 2011.

In February 2015, the Illinois Policy Institute accused the Civic Federation of disregarding historical evidence that taxing and spending don’t solve persistent budget crises, when the federation recommended $23 billion in higher taxes while growing expenditures by more than $11 billion.

“Fortunately taxpayers have a real watchdog, Taxpayers United of America,” said Tobin. “We are the watchdog that watches bogus watchdogs, like the Civic Federation.”